The Main Principles Of Offshore Wealth Management

Wiki Article

The Single Strategy To Use For Offshore Wealth Management

Table of Contents5 Simple Techniques For Offshore Wealth ManagementA Biased View of Offshore Wealth ManagementAll about Offshore Wealth ManagementOffshore Wealth Management Fundamentals ExplainedMore About Offshore Wealth Management

If you are wanting to overseas financial investments to aid protect your assetsor are worried about estate planningit would certainly be sensible to find a lawyer (or a team of lawyers) focusing on property security, wills, or organization succession. You require to take a look at the financial investments themselves and also their lawful and also tax implications - offshore wealth management.In many cases, the advantages of overseas investing are outweighed by the remarkable costs of specialist fees, commissions, and travel costs.

Jacket is an overseas area with ingrained ties to our impact markets. With broad market understanding in riches management and economic structuring, Jersey is considered among one of the most developed and also well-regulated offshore financial centres in the globe.

Getting The Offshore Wealth Management To Work

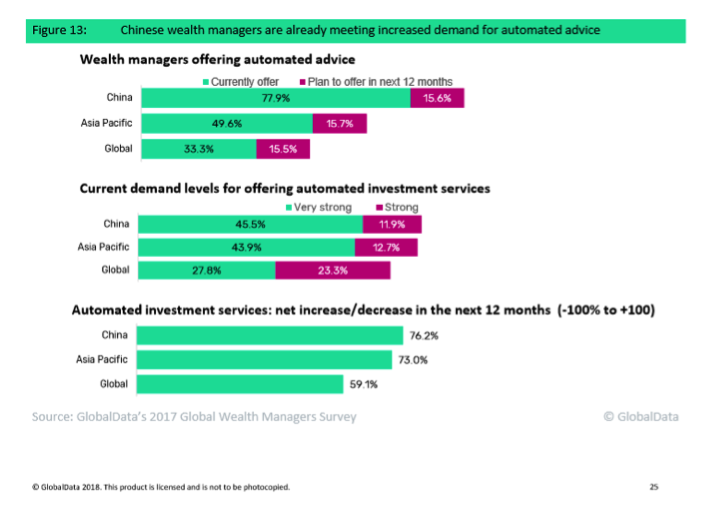

List of Numbers, Number 1: Offshore possessions surged early in the pandemic as investors looked for safe sanctuaries early on and also after that sought investment chances, Number 2: The tidal wave of non-resident wealth into Europe is receding, Figure 3: The main roles of New york city and also London continue to be even after wealth drains from somewhere else in the areas, Number 4: Asia-Pacific is once more back to driving growth in the overseas market, Number 5: Adverse macroeconomic 'press' factors are driving the increase in HNW overseas investment, Figure 6: Australian investors that are keen to straight have a fashionable tech supply are being targeting by moomoo, Figure 7: Privacy and tax were largely missing as vehicle drivers for offshoring throughout the pandemic, Number 8: Financial institutions significantly raised their hiring for law and also conformity in the early months of 2022Figure 9: Regulation-related job employing from Dec 14, 2021 to March 14, 2022 contrasted to previous quarter, Figure 10: The North American market is well provisioned with overseas solutions, Figure 11: Money risk has actually grown over the last 10 years as well as is heightened in times of situation, Number 12: A lot of private wide range companies in the US and also Canada can link customers to overseas partners, Number 13: Citibank's offshore investment choices cover numerous asset classes, Number 14: ESG is simply as crucial as high returns in markets that Requirement Chartered has existence in, Figure 15: Requirement Chartered's worldwide service accommodates both liquid as well as illiquid offshore investments, Figure 16: HSBC Premier India services concentrate on global privileges as well as NRIs (offshore wealth management).There are several, as well as the following are just a few instances: -: in several nations, financial institution down payments do not have the exact same protection as you might have been made use of to in your home. Cyprus, Argentina as well as Greece have actually all supplied examples of banking dilemmas. By using an overseas sites financial institution, based in a highly managed, clear territory with legal protections for capitalists, you can really feel safe in the expertise that your money is risk-free.

A connection supervisor will certainly always supply a personal factor of call that ought to take the time to comprehend you as well as your needs.: as an expat, having the ability to maintain your savings account in one area, despite the amount of times you move countries, is a major benefit. You also know, despite where you remain in the globe, you will have access to your cash.

Not known Details About Offshore Wealth Management

These range from keeping your money outside the tax obligation web of your home nation, to securing it from tax obligations in the country you're presently living in. It can likewise work when it involves estate preparation as, depending on your citizenship as well as tax obligation status, assets that being in your overseas checking account may not undergo estate tax.

Investing with an overseas bank is straightforward as well as there is generally suggestions or devices handy to aid you develop a financial investment portfolio appropriate to your danger account and the results you desire to accomplish. Investing with an overseas checking account is typically much extra flexible and clear than the options that are traditionally utilized.

You can take advantage of these advantages by opening an offshore bank account., like AES International, can open up an offshore exclusive bank account for you within 48 hrs, supplied that all the needs are fulfilled.

The Only Guide for Offshore Wealth Management

Before you spend, make sure you feel comfortable with the level of risk you take. Investments purpose to expand your cash, but they might shed it as well.This is being driven by a strong desire to relocate in the direction of elegance, based upon an approval of international knowledge in regards to products, services and processes. In India, meanwhile, the vast quantity of new wealth being created is productive ground for the appropriate offering. According to these and also other local patterns, the definition as well as range of exclusive banking is changing in a lot of these regional markets in addition to it the demand to have accessibility to a larger range of services and products - offshore wealth management.

The smart Trick of Offshore Wealth Management That Nobody is Discussing

With greater internal knowledge, consumers are most likely to feel a lot more sustained. Consequently, the goal is to grad a larger share of their purse. Nonetheless, international players need to take note of a few of the difficulties their equivalents have faced in specific Learn More Here markets, for instance India. Most of international institutions which have actually established an organization in India have tried to adhere to the same version and also style as in their home nation.

Report this wiki page